Forum Tries to Address Issues of Rising Student Debt

By Adam Bento

Special to the Live Wire

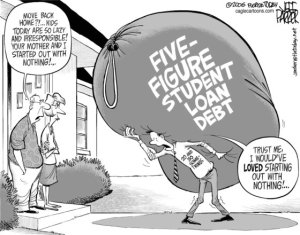

Increased financial literacy among students and organization could help students obtain their college educations without going into crushing debt, said several speakers during a forum on the Student Debt Crises at Manchester Community College Oct. 20.

The event, which was held in the SBM Charitable Foundation Auditorium, was co-sponsored by the MCC Office of Student Activities and the Congress of Connecticut Community Colleges, or the 4C’s, the union that represents faculty and professional staff in all 12 of the state’s community colleges.

T.J. Barber, director of Student Activities at MCC, moderated the discussion.

MCC President Gena Glickman opened the forum with some remarks on the issue. She said there has been an average increase of 3.15 percent in tuition in community colleges around the country, while MCC has only had a 2 percent increase. Glickman also said that seven in 10 students graduate in debt. Steve Cohn, president of the 4C’s, also expressed concern about student debt.

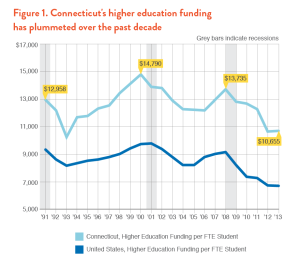

The roots of the crisis lie in the fact that state funding for colleges has declined while costs have risen, said Mark Huelsman, a senior

A chart showing the decline of higher education funding. Photo Credit: http://www.demos.org/publication/connecticuts-great-cost-shift.

policy analyst at Demos. According to its website, Demos is “a public policy organization working to reduce the role of money in politics, create pathways for a diverse middle class and transform the public narrative for better community values and racial equality.”

Huelsman said the cost of a college education has been rising over the last 20 years.

“State funding for full time students has fallen 22 percent from 2008 and 28 percent from 2000,” he said, adding that tuition at both four year colleges and two year colleges has increased dramatically over the past two decades while the number of need-based grants awarded has declined over the past decade. Huelsman credited both facts to the increase in enrollment of students.

Charlene Crowell, communications manager at the Center for Responsible Lending, spoke next about making sure students got federal aid. Crowell said for-profit colleges take 25 percent of all federal student aid, but almost half of the students who default on loans attended one of these schools. She also discussed the Consumer Financial Protection Bureau and its role in making sure students are informed about their rights to modify loans.

So what can students do about higher education debt? Chris Hicks, a representative for Jobs with Justice and the U.S. Student Association, said organizing and knowing your rights as a lender is the first step. He also emphasized the Public Service Loan Forgiveness program. The program would forgive student debt of someone who had worked in public service for 10 years, said Hicks.

But other solutions must come from legislation, said State Sen. Steve Cassano of Manchester.

He talked briefly about the image problem of community colleges and about passing legislation that would make it easier to transfer credits to schools in the state.

The night ended with a Q&A session with the panelists. Both Hicks and Huelsman agreed that education on financial literacy should be provided to students. Crowell further discussed the need for effective regulations of loans. All the panelists agreed that students should get together to face the student debt crisis head on.

For those interested, information about issues regarding student debt can be found on the websites for Demos, www.demos.org, Jobs with Justice at www.jwj.org, and the Center for Responsible Lending at www.responsiblelending.org.